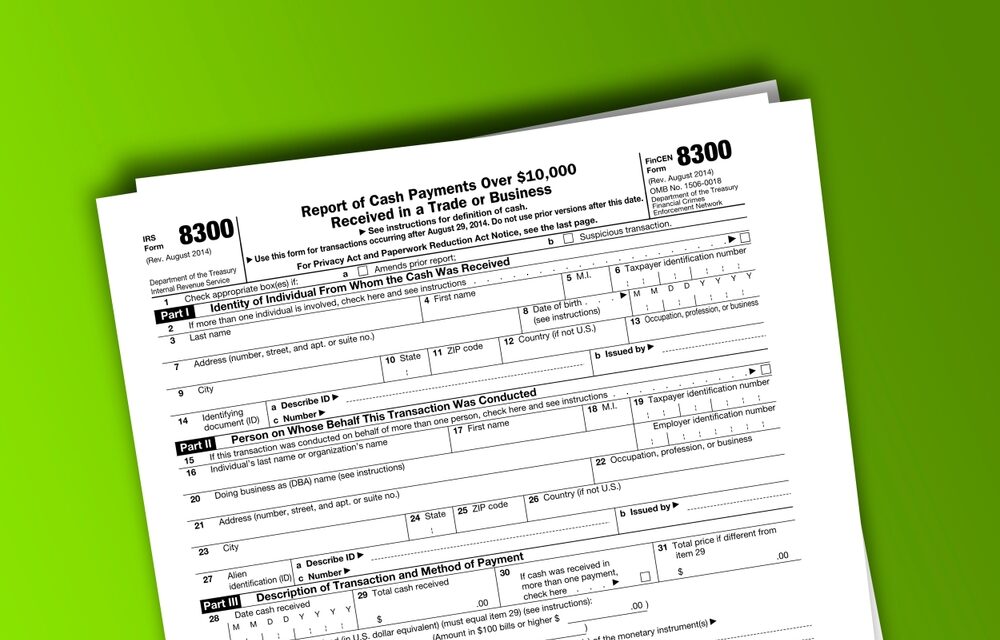

The law requires that a trade or business report cash payments received of more than $10,000 to the federal government on Form 8300. This form was intended to provide valuable information to the Internal Revenue Service (IRS) and the Financial Crimes Enforcement Network (FinCEN) to assist in their efforts to battle money laundering.

Who must file: an individual, company, corporation, partnership, association, trust, or estate who is the recipient of the cash

When to file: Within 15 days after the date of the cash transaction

How to file: Effective 1/1/24, you must file Form 8300 electronically if you are required to file other information reports (1099s, W-2, etc.) electronically. Remember that the threshold for the number of information reports will be 10 starting on 1/1/24. The form can be filed through the FinCEN Bank Secrecy Act (BSA) Electronic Filing (E-Filing) System (http://bsaefiling.fincen.treas.gov/main.html)

Types of payments to report: The law requires that a trade or business report cash payments received when:

- The amount of the cash received is greater than $10,000

- The business receives the cash in a single lump sum, or in installment payments within 12 months that total more than $10,000

- The recipient receives the cash in the ordinary course of a trade or business

- The same agent or buyer provides the cash

- Business receiving the cash in a single transaction or in related transactions

What does CASH include:

- Coins and currency of the U.S. and a foreign country

- Cashier’s checks, bank drafts, traveler’s checks, and money orders when under $10k (if sum is over $10,000 for the transaction, i.e. $6,001 in currency and $4,000 in cashier’s check)

What is NOT CASH:

- Personal checks drawn on the account of the writer

- Cashier’s checks, bank drafts, traveler’s checks, and money orders with a face value of over $10,000. When a customer uses currency of more than $10,000 to purchase a monetary instrument, the financial institution issuing the cashier’s check, bank draft, traveler’s check, or money order is required to report the transaction by filing FinCEN Form 104, Currency Transaction Report.

What is a Related Transaction: Related transactions are transactions between payer and recipient occurring within a 24 hour period. 24 hour period is 24 hours, and not necessarily a calendar day or banking day.

Additional requirement: A business must obtain the correct TIN of the person(s) from whom they receive the cash. If the transaction is conducted on behalf of another person or persons, the business must also obtain the TIN of that person or persons.

We have listed the general rules; for more detailed information on filing Form 8300, please contact your HM&M Advisor.

Latest News

On June 9, the IRS released Announcement 2022-13, which modifies Notice 2022-3, by revising the optional standard mileage ...

At the tail end of 2021, the Internal Revenue Service (IRS) released new Schedules K-2 and K-3 effective ...

This information is current as of Sunday, November 21, 2021. On Friday, November 19, 2021, after the Congressional ...

HM&M Updates

DALLAS, Dec. 11, 2024 – Springline Advisory, a trailblazing financial and business advisory firm, is proud to announce its partnership ...

Last month, Senior Manager, Pearl Balsara was invited to speak at the 2023 FPA DFW Annual Conference in ...

We are pleased to announce the winners of the 2022 HM&M Excellence Awards. Ronna Beemer, Keith Phillips, and ...